In the intricate realm of investing, identifying the appropriate solution for individuals keen on the Forex market yet lacking the specialized knowledge or adequate time to oversee trades personally has consistently posed a challenge. A PAMM account presents an innovative solution that enables investors to leverage the expertise of professional traders.

This investment model provides a distinctive opportunity for individuals who aspire to gain profits from the potential of the Forex market without the concerns of direct management. Read this article to learn more about a PAMM trading account.

What is a PAMM Trading Account?

A PAMM account in forex, short for “Percentage Allocation Management Module,” is an investment tool that allows Forex market investors to entrust their money to a professional manager, who manages it together with the funds of other investors.

Through this approach, investors can leverage the expertise and abilities of a professional trader without needing to engage directly in the trading activities.

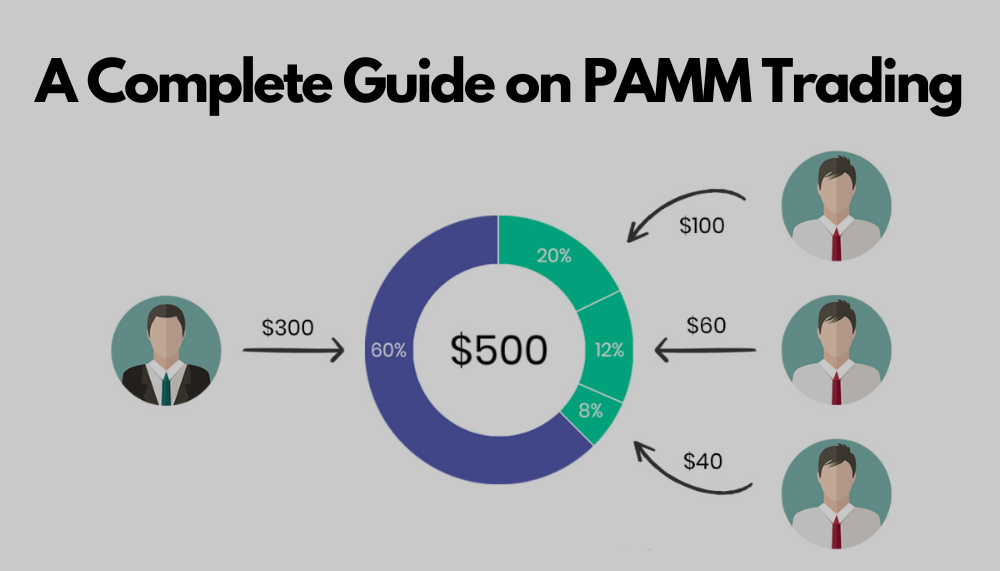

In a PAMM trading account, the capital of several investors is aggregated into a shared account, which is then utilized by the account manager (the trader) to execute trades in the Forex market.

The gains or losses from these trades are allocated based on the proportion of each investor’s capital. This approach is particularly advantageous for those who lack the expertise or time to participate in forex trading independently.

Financial transparency is one of the benefit of a PAMM forex account is its financial transparency. This indicates that both transactions and the performance of the account are completely accessible to investors.

Moreover, the account manager is prohibited from utilizing the investors’ capital for any purposes outside of the pre-established trades, as they lack direct control over the individual accounts. This arrangement fosters trust between the investors and the account manager.

Advantages of a PAMM Account

The PAMM account serves as a widely used investment tool within the forex market, drawing in numerous investors thanks to its various benefits. Below are some significant advantages of this account type:

- Entry to the Forex Market without Specialized Knowledge: The Forex market stands as one of the most intricate and ever-changing financial markets globally. It requires a deep knowledge and experience in market analysis, currency trading techniques, and risk management in forex. The PAMM account enables investors to access the Forex market and take advantage of its opportunities without requiring specialized knowledge or experience.

- Expert Capital Management: A key advantage of a PAMM account in forex is that professional traders manage the funds. The account manager, with extensive Forex trading experience, oversees the pooled capital, benefiting those who lack the time or skills for direct management.

- Financial Clarity: PAMM trading accounts provide transparency, enabling investors to track the manager’s performance in real-time. Brokers offer dashboards that display trades, gains and losses, and strategies, fostering trust between investors and the manager.

- Low Minimum Investment: Numerous PAMM accounts permit investors to participate in the market with a comparatively low initial investment. This aspect makes PAMM accounts appealing for those with limited funds or novice investors.

- Diversification and Risk Mitigation: PAMM trading accounts enable investors to allocate their capital among several account managers employing different strategies. This method reduces risk and increases the chances of achieving positive returns.

- No Requirement for Active Trade Management: With a PAMM account in forex, traders are not required to keep an eye on the market or carry out trades on their own. All trading decisions are handled by the account manager, making it particularly attractive for busy individuals or those who wish to avoid direct management of their capital.

Risks and Disadvantages of a PAMM Account

While the PAMM trading account provides numerous benefits, it also presents risks and challenges that investors need to recognize:

- Dependence on the Account Manager: The account manager is responsible for all the decisions made by them in a PAMM forex trading account. As a result, investors place complete trust in the manager’s knowledge, experience, and strategies. If the manager makes unwise choices or fails to perform, investors could incur losses.

- Forex Market Risks: The Forex market carries significant risks because of its extreme volatility. Even the most skilled account managers cannot eliminate all market risks. Elements such as abrupt currency fluctuations, economic announcements, or political actions can adversely affect trades.

- Limited Transparency Regarding Trading Strategies: While investors have access to the performance metrics of the PAMM account, the detailed trading strategies utilized by the manager are generally not disclosed in their entirety. Consequently, investors might lack comprehensive insights into how their funds are being handled.

- Restricted Authority Regarding Trades: Participants in a PAMM account lack control over the trades and are unable to modify the manager’s strategy. This can be restrictive for those who desire direct oversight of their investments.

Who Can Use a PAMM Account?

A PAMM account serves as an excellent choice for various types of investors due to its flexibility. Below are the primary categories of individuals who can benefit from it:

- Novice Traders: For individuals who are new to forex trading and do not have a lot of experience, a PAMM account can be beneficial. It allows them to invest without needing to grasp all the intricate details of the market.

- Busy Investors: Many individuals find themselves too occupied with work or personal commitments to study the market or execute trades. A PAMM account is ideal for them since it eliminates the need for direct management of their investments.

- Investors with Limited Funds: A PAMM account is an excellent option for individuals who lack substantial capital to invest, as it requires a minimal initial investment.

- Investors Seeking Diversification: Those looking to broaden their investment horizons and incorporate forex into their portfolio can take advantage of a PAMM account.

- Seasoned Investors: Even seasoned traders may opt for PAMM accounts to adopt the strategies of professional managers or to further diversify their investment portfolios.

How does a PAMM account work?

The working of a PAMM account consists of multiple steps that both investors and account managers need to adhere to:

1. Investor Registration: To begin with, the investor is required to register with a reliable PAMM accounts broker. Once registered, the investor can view a selection of account managers and select one to oversee their funds.

2. Selecting the Account Manager: Choosing the right account manager is an essential step in effectively utilizing a PAMM trading account. Investors must assess the manager’s historical performance, profitability, trading approach, and risk appetite.

3. Funds Deposit: Once the investor selects an account manager, they will put a certain amount into the PAMM account. This amount is then pooled together with contributions from other investors.

4. Account Manager Trades: The account manager employs the collective funds to execute transactions in the Forex market. The manager maintains complete authority over the trades, and investors do not participate in this process.

5. Transparency and Monitoring: Investors can track the account’s performance via dashboards offered by the broker. These dashboards present information including profits or losses, the overall count of trades, and details regarding the manager’s strategy.

6. Profit and Loss Distribution: After the trading period, any profits or losses are allocated to the investors based on the proportion of their investment. The account manager typically receives a percentage of the profits as compensation.

7. Withdrawals or Extra Investments: Investors can choose to either withdraw their profits or contribute additional capital to the account after the trading period.

Common Trading Strategies in PAMM Accounts

PAMM account managers generally employ a range of strategies to oversee trades. Risk management techniques, including controlling trade volume, establishing stop-losses and take-profits, and diversifying investments, hold significant importance.

Some managers rely on technical analysis to spot price patterns and decide on entry and exit points, whereas others concentrate on fundamental analysis to assess overall market conditions and the effects of economic factors.

Furthermore, algorithmic trading strategies that utilize AI and machine learning tools have gained popularity in this sector. The primary objective of these strategies is to enhance profits while reducing the risk of losses for investors.

Importance of PAMM Account Manager in Capital Management

The account manager plays a vital role in determining the success or failure of this type of investment. Their duties encompass:

- Overseeing Trades: The manager holds the responsibility of executing trades with the pooled capital. They need to generate optimal returns for investors by analyzing the market, employing professional trading strategies, and effectively managing risk.

- Risk Management: One of the fundamental responsibilities of a manager is to oversee risk. They are tasked with safeguarding investors’ capital by employing different strategies, including stop-loss orders and trade diversification.

- Transparency: The account manager is required to deliver precise and transparent performance reports, detailing trades, profits or losses, and the strategies implemented. This transparency builds trust between the manager and the investors.

- Adhering to Regulations: The account manager is required to comply with the rules established by the broker. These rules impose restrictions on the utilization of investors’ capital to safeguard the funds.

- Aligning with Investor Interests: Typically, the account manager earns a portion of the profits as compensation. This arrangement motivates the manager to act professionally and deliver substantial returns for investors.

The PAMM account manager needs to possess adequate experience and expertise in Forex trading, as their performance has a direct effect on the profitability of investors. Selecting a skilled and trustworthy manager is among the most crucial elements for achieving success with a PAMM account.

The Importance of the Broker in PAMM Accounts

Brokers are essential in establishing and maintaining the infrastructure for PAMM accounts.

They serve as intermediaries connecting investors with account managers, enabling effective capital management. This involves providing transparent and secure platforms for trade management, ensuring precise records of fund distributions, and overseeing the performance of managers.

Brokers guarantee that every transaction is executed per established rules and regulations. By offering comprehensive reports and ensuring transparency in financial accounts, brokers foster trust among investors. Moreover, brokers usually impose restrictions to mitigate the risk of misuse or management mistakes.

Distribution of Profits and Losses in a PAMM Trading Account?

In a PAMM trading account, the allocation of profits and losses corresponds to the initial investment contributed by each investor. This indicates that every investor participates in the overall profit or loss according to the percentage of their contribution.

For instance, if three investors together invest $100,000 and the account manager generates a 10% profit, the total profit amounts to $10,000. After the deduction of the manager’s fee, the leftover amount will be allocated to the investors based on the ratio of their investments. For instance, if the manager’s fee is set at 20%, then $8,000 will be distributed among the investors.

This system offers great transparency, enabling investors to consistently track the performance of their accounts.

How to Open a PAMM Account?

Opening a PAMM trading account involves several steps, including selecting the appropriate broker and configuring initial settings.

- Select a Broker: Begin by choosing a trusted forex trading broker that provides PAMM account services. The broker must have a solid reputation and a robust regulatory framework.

- Establish an Account: Once you have chosen a broker, proceed to create an account by submitting your personal and financial details.

- Select an Account Manager: Typically, brokers offer a list of PAMM account managers, including details about their historical performance, trading methods, and risk profiles.

- Fund Your Account: After you have chosen a manager, deposit the amount you intend to invest. This investment will be pooled with the contributions of other investors in the PAMM account.

- Monitor and Adjust: After funding your account, you can observe the account’s performance via a monitoring dashboard and make adjustments as needed.

This method enables investors to easily access the forex market and leverage the expertise of professional managers.

How to Choose the Best PAMM Account Manager?

Selecting the appropriate account manager is a crucial step when utilizing a PAMM account. Below are the essential criteria for choosing a manager:

- Evaluating Historical Performance: One of the primary aspects to assess is the manager’s previous performance. Historical data can reveal profitability, risk management strategies, and the manager’s consistency in results.

- Previous Losses: Besides profitability, it is vital to examine the losses the manager has faced. Managers who can keep losses within a manageable range are the preferred choice for investment.

- Manager’s Trading Strategy: The trading strategy of the manager must correspond with your financial objectives and risk appetite. Certain managers might adopt aggressive, high-risk approaches, whereas others may lean towards more conservative trading methods.

- Transparency Level: Managers who offer transparent details regarding their strategies, performance, and trades are likely to foster greater trust. Transparency enables investors to make better-informed choices.

- Fees and Commissions: Before selecting a manager, it is crucial to examine their fee structure. Managers with elevated fees can diminish the investor’s net returns.

- Manager’s Experience: Managers who possess greater experience in managing PAMM accounts in forex tend to be more adept at navigating different market conditions and are generally safer choices.

- Investor Insights: Evaluating the perspectives of fellow investors regarding the manager’s performance can provide you with a clearer understanding of their strengths and weaknesses.

Commonly Asked Questions

Q1. How do I start a PAMM account?

A. To kick off a PAMM account, here’s what you usually need to do:

- Pick a broker that provides PAMM services.

- Sign up for an account and finish any required verification steps.

- If you’re looking to invest, choose a PAMM manager by checking out their performance and risk profile.

- If you’re the manager, you’ll need to create a PAMM account and establish the parameters for your investors.

- Finally, deposit funds into the PAMM account.

Q2. Are PAMM accounts safe?

A. PAMM accounts are becoming a popular option for individual investors who want a safe and straightforward way to invest. PAMM Manager has made a name for itself worldwide in managing these accounts, providing investors with a service that is transparent, trustworthy, and geared towards generating profits.

Q3. What are the risks of a PAMM account?

A. When it comes to investing in financial markets, PAMM accounts come with their own set of risks. If the account manager doesn’t make the right trades, investors might end up facing losses, too. Even though these accounts are managed by professionals, there’s no promise that you’ll make a profit, and it’s possible to lose some of the money you’ve invested.

Q4. Are PAMM accounts legal?

A. PAMM accounts are legal in many countries. To ensure a secure investment experience, it’s crucial to select a trustworthy and regulated forex broker that offers PAMM services. Taking this step can help reduce potential risks and enable investors to take advantage of professional money management.

Q5. Is a PAMM account profitable?

A. PAMM is a distinctive investment approach that provides investors with impressive returns and ease of use. However, it’s essential to grasp how the account functions before diving in. Essentially, a PAMM account is a financial tool created by brokers to help manage funds effectively.

Conclusion

To make informed investment decisions, it is essential to have a comprehensive grasp of the functioning of PAMM accounts and the prevalent risks involved.

You must conduct a detailed examination of money managers, considering their qualifications, past performance, and client reviews.

If approached correctly, the guidance and perspectives of your account manager will significantly aid you in confidently navigating the complexities of Forex trading and PAMM trading accounts.